Contents:

The Positive Directional indicator (+DI) equals 100 times the EMA of +DM divided by the ATR for a set number of periods . The chart above shows AT&T with three signals over a 12-month period. These three signals were pretty good, provided profits were taken and trailing stops were used.

It shows that the stock price is rising with a positive momentum. Once you have become familiar with this ADX trading strategy and are confident with its limitations and its strengths, give it a test in real-time. Look for support from other indicators, and do not fret if false alerts occur.

As always, individual technical indicators should never be relied upon in isolation. They should be part of a trader’s decision making process. This trading system involves searching for signals based on RSI and assessing the trend strength by the index.

Similarly, a sell order can be placed when the price is edging higher, with an ADX reading of below 25 and when the RSI is showing overbought conditions. An uptrend is in place when the +DI is above the -DI; whereas a downtrend is in place when -DI is above the +DI. When +DI and -DI crosses, it indicates that a trend reversal is occurring. The trend is turning bullish if +DI is crossing above -DI; similarly, the trend is turning bearish if -DI is crossing above +DI.

Due to timeframe restrictions, scalping and swing trading aren’t suitable. As soon as ADX rises above 20%, open a short Forex trading position as -DI is at the top. The stop-out level is the previous candle high, the yellow line. It’s reasonable to set a trailing stop instead of the regular stop. In the Levels tab, add fixed horizontal levels to visually limit the main range of movement of the indicator and overbought/oversold zones.

It includes a series of indicators that describe the nature of the trend price movement – its direction and the trend strength. You are already familiar with one of them – one of the main MT4 indicators —ATR, average true range. Trading in the direction of a strong trend reduces risk and increases profit potential.

Secondly, to determine the trend’s strength in a trending market. Finally, it is also often used, as other momentum indicators are, to indicate a potential market reversal or trend change. However, it’s important to remember that like any other technical tool, it comes with particular limitations and may be prone to some false signals.

First, it is a relatively difficult indicator to calculate. Second, when used alone, the ADX indicator can show you the wrong signals as shown above. Finally, it can only be used in some market conditions such as when the asset is trending. The process of getting the ADX starts by calculating the true range , +DM, and -DM. The next step is to smooth the periodic values gotten above.

Crosses of +DMI and -DMI make a trading system in combination with ADX. This line registers a trend’s strength but it doesn’t show its direction. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

Is Abu Dhabi National Oil Company for Distribution PJSC’s (ADX:ADNOCDIST) ROE Of 80% Impressive?.

Posted: Sun, 16 Apr 2023 04:16:08 GMT [source]

The two indicators are similar in that they both have lines representing positive and negative movement, which helps to identify trend direction. The Aroon reading/level also helps determine trend strength, as the ADX does. The calculations are different though, so crossovers on each of the indicators will occur at different times. The Average directional movement index is an indicator that traders use to identify the strength of a trend. The indicator is categorized in the trending category of indicators.

10 Best SIP Plans in India to Invest in April What is SIP? SIP or Systematic Investment Plan is a method of investing a fixed amount in … Top 10 Chit Fund Schemes in India in Chit funds are one of the most popular return-generating saving schemes in India. 12 Best Investment Plans in India in April 2023 – Returns & Benefits Working extra hard to earn money? Types of Fixed Deposit in 2023 – Know Different Types of FDs and How to Choose Fixed deposits are a popular investment option offered by banks and other financial instituti… Want to put your savings into action and kick-start your investment journey 💸 But don’t have time to do research?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The signal is provided when the +DI and -DI crossover strategy occurs with the index line turning downward in the 40-60% zone. A flat can be identified by the main indicator line that is below 20% and its horizontal movement. Open the trade after the +DI and -DI crossover with the index line exiting the 0-20 zone.

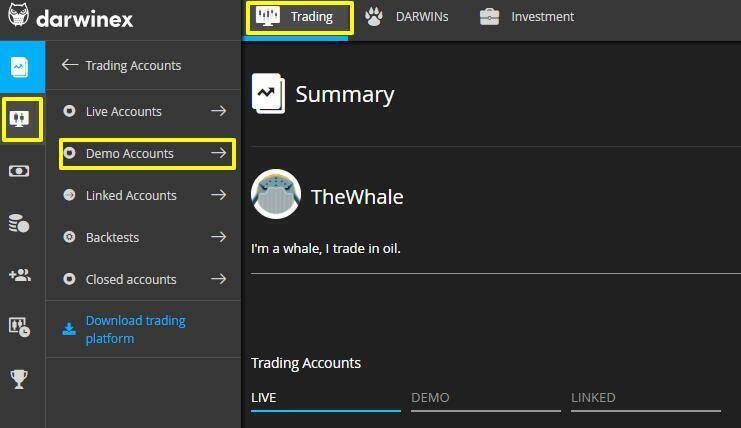

As a what is adxr, understanding these calculations is important, but not necessary. Learning how to use this helpful indicator and incorporate it into your daily routine is best achieved with hours of practice trading on a free demo system. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request.

Therefore, during the flat movement, it will give a lot of false signals. The ADX is a combination of two other indicators developed by Wilder, the positive directional indicator (abbreviated +DI) and negative directional indicator (-DI). The ADX combines them and smooths the result with a smoothed moving average.

Navigatr Group Centralizes Partner Relations, Appoints Andrew ….

Posted: Thu, 20 Apr 2023 15:08:53 GMT [source]

ADX Crossover shows when the main index line crosses the set level with an arrow. The oscillator on the H4 interval shows + DI and -DI continue to diverge with the growth of the index line. Having sorted out the theory, let’s look at some practical examples on how to use ADX in Forex trading.

The https://traderoom.info/ indicator can be found on your platform’s charting software. It is respresented in the image below by the blue line on the lower chart. I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe. The red arrow on the chart indicates the point of opening the trade. If the RSI, while being in the overbought and oversold zones, went back a few candles and returned, it’s not considered a repeating signal.

With this disclaimer in mind, the “Green” circles on the above chart illustrate optimal entry and exit points based on the ADX strategy alone. “A” through “F” annotations illustrate those regions on the candlesticks. The divergence noted suggests a patient holding strategy, as well.

When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with. The directional movement index is an indicator that identifies whether an asset is trending by comparing highs and lows over time. Designed by Welles Wilder for commodity daily charts, the ADX is now used in several markets by technical traders to judge the strength of a trend. However, there are other cons of using the indicator.

Divide the 14-day smoothed Plus Directional Movement (+DM) by the 14-day smoothed True Range to find the 14-day Plus Directional Indicator (+DI14). This +DI14 is the green Plus Directional Indicator line (+DI) that is plotted along with the ADX line. Smooth these periodic values using Wilder’s smoothing techniques. Directional movement is calculated by comparing the difference between two consecutive lows with the difference between their respective highs.

Copyright © 2022 NSS College For Womens. | Created By Akira Software Solutions